#FSI Calculation for Housing Projects

Explore tagged Tumblr posts

Text

Group Housing FSI Available for Sale in Lucknow – Unlock Prime Development Potential

Lucknow, the capital city of Uttar Pradesh, is emerging as one of India's fastest-growing real estate hubs. With its expanding infrastructure, strategic location, and increasing demand for modern housing solutions, group housing FSI (Floor Space Index) available for sale in Lucknow presents a golden opportunity for real estate developers. Investors and builders looking to capitalize on the city's booming real estate market should not miss the chance to acquire FSI for group housing projects in key locations of Lucknow.

Understanding FSI and Its Significance in Group Housing Projects

Floor Space Index (FSI), also known as Floor Area Ratio (FAR), is the ratio of the total built-up area of a building to the total plot area. This metric determines how much construction is permissible on a given plot of land. Higher FSI availability allows developers to build high-density residential projects, maximizing their return on investment while catering to the growing demand for urban housing.

With the rapid urbanization of Lucknow, acquiring FSI for group housing projects enables developers to create well-planned, high-rise residential communities that offer modern amenities, green spaces, and excellent connectivity.

Prime Locations Offering Group Housing FSI in Lucknow

Several prime locations in Lucknow offer lucrative opportunities for group housing development. Some of the best areas for investment in FSI for group housing include:

1. Gomti Nagar Extension

One of the most sought-after localities in Lucknow, Gomti Nagar Extension, is a prime residential and commercial hub. With excellent connectivity via Shaheed Path, proximity to IT parks, shopping malls, and educational institutions, investing in group housing FSI in this area guarantees high demand and excellent returns.

2. Amar Shaheed Path

This developing corridor is an ideal choice for high-rise residential projects. The area boasts seamless connectivity to Lucknow Airport, major expressways, and commercial centers, making it a perfect location for luxury and affordable housing developments.

3. Sultanpur Road

With the Lucknow-Sultanpur highway expansion, this region is witnessing tremendous growth in residential projects. The availability of group housing FSI in Sultanpur Road ensures developers can cater to the rising demand for affordable and mid-segment housing.

4. Raebareli Road

A fast-growing locality with multiple educational institutions, hospitals, and commercial developments, Raebareli Road presents an excellent opportunity for developers looking to launch large-scale residential projects with modern amenities.

5. Faizabad Road

Known for its strategic location and upcoming metro connectivity, Faizabad Road is another hotspot for group housing FSI investment. The region offers an ideal mix of affordability and luxury, making it a prime area for large-scale development.

Advantages of Investing in Group Housing FSI in Lucknow

1. High Demand for Residential Projects

Lucknow's growing population, coupled with increasing urbanization, has led to a significant rise in demand for quality housing projects. Group housing developments are ideal for catering to this demand, offering well-planned apartments with modern amenities.

2. Strong Connectivity and Infrastructure Development

The city's rapid infrastructure development, including metro expansion, new expressways, and better road networks, ensures seamless connectivity across major localities, enhancing the appeal of group housing projects.

3. Affordable Land Prices with High ROI Potential

Compared to other metropolitan cities, Lucknow offers relatively affordable land prices, allowing developers to maximize their investments. The rising property rates ensure high returns on investment (ROI) in the long run.

4. Government Incentives and Policies

With the Uttar Pradesh Real Estate Regulatory Authority (UP-RERA) promoting planned urbanization, various government policies encourage group housing projects. Incentives such as tax benefits, ease of approvals, and development schemes make FSI investments highly attractive.

5. Rising Demand for Gated Communities and Luxury Apartments

The demand for gated communities, high-rise apartments, and integrated townships is growing among homebuyers in Lucknow. Investing in group housing FSI ensures developers can cater to the rising expectations of homebuyers seeking modern lifestyle amenities.

Factors to Consider Before Purchasing Group Housing FSI in Lucknow

While investing in group housing FSI in Lucknow offers multiple benefits, developers must consider the following factors:

Zoning and Regulatory Approvals: Ensure compliance with local municipal regulations, FSI norms, and RERA guidelines before purchasing land or FSI.

Market Demand Analysis: Conduct thorough market research to identify the right segment—affordable, mid-segment, or luxury housing.

Infrastructure and Connectivity: Choose a location with existing or upcoming infrastructure projects to ensure high demand.

Amenities and Project Planning: Focus on offering modern amenities such as clubhouses, green spaces, security systems, and recreational facilities.

Budget and Financial Planning: Factor in the cost of land acquisition, construction, approvals, and marketing to ensure a profitable venture.

How to Acquire Group Housing FSI in Lucknow?

Developers and investors looking to acquire group housing FSI in Lucknow can follow these steps:

Identify Prime Locations – Research high-growth areas with excellent connectivity and infrastructure.

Engage with Real Estate Consultants – Work with property experts to find the best deals on FSI sales.

Verify Legal Documentation – Ensure all FSI approvals, land titles, and municipal clearances are in place.

Plan and Design the Project – Collaborate with architects and planners to create an optimized housing project.

Get RERA Registration – Ensure compliance with Uttar Pradesh RERA for smooth project execution.

Market the Project Effectively – Use digital marketing, real estate listings, and offline promotions to attract homebuyers.

Conclusion: Invest in Lucknow’s Booming Group Housing Market Today

Lucknow’s real estate market is witnessing unprecedented growth, making it the perfect time to invest in group housing FSI. With prime locations, affordable land rates, and increasing demand for modern residential communities, developers can unlock massive potential in this thriving city.

For real estate developers, acquiring FSI for group housing projects in Lucknow ensures long-term profitability, sustainable urban development, and enhanced lifestyle experiences for homebuyers.

#Group Housing FSI for Sale#Group Housing FSI in Lucknow#FSI Available for Sale in Lucknow#Floor Space Index for Group Housing#Group Housing Development in Lucknow#FSI Rules for Group Housing#Real estate investment in Lucknow#Affordable Housing FSI in Lucknow#FSI Calculation for Housing Projects#Lucknow Property Development FSI

0 notes

Text

Real Estate Consulting Company in Bangalore

When it comes to real estate development, various factors determine the scope and scale of a construction project. One of the most crucial factors is Floor Space Index (FSI), also known as Floor Area Ratio (FAR). Understanding FSI is essential for developers, investors, and homeowners to ensure compliance with regulations and optimize space utilization. In this blog, we will delve deep into what is FSI in real estate, its significance, calculation, and its impact on property development. We will also explore how a Real Estate Consulting Company in Bangalore can assist in understanding and implementing FSI regulations effectively.

What Is FSI in Real Estate?

FSI, or Floor Space Index, is the ratio of the total built-up area of a building to the total plot area on which it is constructed. It is a regulatory measure used by urban planning authorities to control the density of construction in a given area. The primary objective of FSI is to maintain a balance between infrastructure, open spaces, and population density.

To put it simply, what is FSI in real estate? It is a guideline that dictates how much construction is permissible on a given plot of land. For instance, if a plot has an FSI of 2.0, it means that the total built-up area can be twice the size of the land area.

A Real Estate Consulting Company in Bangalore can provide in-depth insights and guidance regarding FSI norms, ensuring that developers adhere to regulations while maximizing the utility of their land.

How Is FSI Calculated?

The calculation of FSI is straightforward. The formula is:

For example, if a plot has an area of 1,000 square meters and the permissible FSI is 2.0, then the total built-up area allowed would be:

square meters.

Different cities and zones have varying FSI limits depending on factors such as road width, infrastructure, and urban planning norms. Consulting a Real Estate Consulting Company in Bangalore can help developers determine the applicable FSI and plan their projects accordingly.

Types of FSI

1. Basic FSI

This is the standard FSI allowed for a particular zone without any additional premiums or charges.

2. Premium FSI

Developers can avail extra FSI by paying a premium to the governing authorities, subject to specific conditions.

3. TDR-Based FSI

Transfer of Development Rights (TDR) allows developers to obtain additional FSI by acquiring development rights from other landowners or authorities.

4. Special FSI

Some locations, such as transit-oriented developments (TODs), may have special FSI provisions to encourage high-density development near transport hubs.

Importance of FSI in Real Estate

1. Regulates Urban Development

What is FSI in real estate controls the density of construction in a given area, preventing overcrowding and maintaining infrastructural balance.

2. Impacts Property Valuation

Higher FSI can increase property value as it allows more built-up area, making it an attractive investment opportunity.

3. Ensures Sustainable Growth

Urban planning authorities use FSI regulations to ensure balanced growth, optimizing resources and public amenities.

4. Influences Design and Construction

Architects and developers must consider FSI while designing projects to comply with legal norms and maximize space efficiency.

Factors Affecting FSI

1. Location and Zone Regulations

FSI varies depending on whether the property is in a commercial, residential, or industrial zone.

2. Road Width

Wider roads often allow higher FSI as they can accommodate increased population density and infrastructure needs.

3. Type of Construction

High-rise buildings generally require higher FSI, whereas low-density housing developments have lower FSI limits.

4. Government Policies

Local and national policies influence FSI regulations, with periodic revisions based on urban development strategies.

A Real Estate Consulting Company in Bangalore can assist developers in navigating these factors to optimize their projects within the regulatory framework.

How to Optimize FSI for Real Estate Projects?

Maximizing FSI efficiently requires careful planning. Here are some strategies:

Understand Local Zoning Laws: Ensure compliance with municipal regulations.

Utilize TDR: Purchase additional FSI through TDR for larger developments.

Leverage Premium FSI: Consider paying a premium for extra buildable area.

Incorporate Smart Design: Use vertical expansion and space-saving designs.

Work with Experts: A Real Estate Consulting Company in Bangalore can help navigate legal and technical aspects.

Consulting with a Real Estate Consulting Company in Bangalore ensures that real estate projects comply with FSI norms while achieving maximum efficiency.

How a Real Estate Consulting Company in Bangalore Can Help

Understanding what is FSI in real estate and its implications can be complex, especially with varying local regulations. A Real Estate Consulting Company in Bangalore provides expert guidance on:

FSI Regulations: Advising on permissible FSI based on location and zoning laws.

Project Feasibility: Analyzing the impact of FSI on project viability and returns.

Legal Compliance: Ensuring that projects adhere to building codes and approval processes.

Optimization Strategies: Helping developers maximize land utilization while maintaining regulatory compliance.

By consulting with a Real Estate Consulting Company in Bangalore, developers can make informed decisions, ensuring compliance with regulations while maximizing profitability.

Whether you are a builder, investor, or homebuyer, knowledge of FSI helps in making strategic real estate investments. If you are planning a real estate project in Bangalore, partnering with industry experts ensures a smooth and profitable journey.

Conclusion

FSI is a critical aspect of real estate development that impacts project feasibility, valuation, and sustainability. Understanding what is FSI in real estate is essential for developers, investors, and homeowners looking to make informed decisions. Collaborating with a Real Estate Consulting Company in Bangalore ensures that projects comply with FSI regulations while optimizing space and profitability. Whether you are planning a residential or commercial project, professional consultation can help streamline the process, making your real estate venture a success

0 notes

Text

Real Estate Consulting Company in Bangalore

When it comes to real estate development, various factors determine the scope and scale of a construction project. One of the most crucial factors is Floor Space Index (FSI), also known as Floor Area Ratio (FAR). Understanding FSI is essential for developers, investors, and homeowners to ensure compliance with regulations and optimize space utilization. In this blog, we will delve deep into what is FSI in real estate, its significance, calculation, and its impact on property development. We will also explore how a Real Estate Consulting Company in Bangalore can assist in understanding and implementing FSI regulations effectively.

What Is FSI in Real Estate?

FSI, or Floor Space Index, is the ratio of the total built-up area of a building to the total plot area on which it is constructed. It is a regulatory measure used by urban planning authorities to control the density of construction in a given area. The primary objective of FSI is to maintain a balance between infrastructure, open spaces, and population density.

To put it simply, what is FSI in real estate? It is a guideline that dictates how much construction is permissible on a given plot of land. For instance, if a plot has an FSI of 2.0, it means that the total built-up area can be twice the size of the land area.

A Real Estate Consulting Company in Bangalore can provide in-depth insights and guidance regarding FSI norms, ensuring that developers adhere to regulations while maximizing the utility of their land.

How Is FSI Calculated?

The calculation of FSI is straightforward. The formula is:

For example, if a plot has an area of 1,000 square meters and the permissible FSI is 2.0, then the total built-up area allowed would be:

square meters.

Different cities and zones have varying FSI limits depending on factors such as road width, infrastructure, and urban planning norms. Consulting a Real Estate Consulting Company in Bangalore can help developers determine the applicable FSI and plan their projects accordingly.

Types of FSI

1. Basic FSI

This is the standard FSI allowed for a particular zone without any additional premiums or charges.

2. Premium FSI

Developers can avail extra FSI by paying a premium to the governing authorities, subject to specific conditions.

3. TDR-Based FSI

Transfer of Development Rights (TDR) allows developers to obtain additional FSI by acquiring development rights from other landowners or authorities.

4. Special FSI

Some locations, such as transit-oriented developments (TODs), may have special FSI provisions to encourage high-density development near transport hubs.

Importance of FSI in Real Estate

1. Regulates Urban Development

What is FSI in real estate controls the density of construction in a given area, preventing overcrowding and maintaining infrastructural balance.

2. Impacts Property Valuation

Higher FSI can increase property value as it allows more built-up area, making it an attractive investment opportunity.

3. Ensures Sustainable Growth

Urban planning authorities use FSI regulations to ensure balanced growth, optimizing resources and public amenities.

4. Influences Design and Construction

Architects and developers must consider FSI while designing projects to comply with legal norms and maximize space efficiency.

Factors Affecting FSI

1. Location and Zone Regulations

FSI varies depending on whether the property is in a commercial, residential, or industrial zone.

2. Road Width

Wider roads often allow higher FSI as they can accommodate increased population density and infrastructure needs.

3. Type of Construction

High-rise buildings generally require higher FSI, whereas low-density housing developments have lower FSI limits.

4. Government Policies

Local and national policies influence FSI regulations, with periodic revisions based on urban development strategies.

A Real Estate Consulting Company in Bangalore can assist developers in navigating these factors to optimize their projects within the regulatory framework.

How to Optimize FSI for Real Estate Projects?

Maximizing FSI efficiently requires careful planning. Here are some strategies:

Understand Local Zoning Laws: Ensure compliance with municipal regulations.

Utilize TDR: Purchase additional FSI through TDR for larger developments.

Leverage Premium FSI: Consider paying a premium for extra buildable area.

Incorporate Smart Design: Use vertical expansion and space-saving designs.

Work with Experts: A Real Estate Consulting Company in Bangalore can help navigate legal and technical aspects.

Consulting with a Real Estate Consulting Company in Bangalore ensures that real estate projects comply with FSI norms while achieving maximum efficiency.

How a Real Estate Consulting Company in Bangalore Can Help

Understanding what is FSI in real estate and its implications can be complex, especially with varying local regulations. A Real Estate Consulting Company in Bangalore provides expert guidance on:

FSI Regulations: Advising on permissible FSI based on location and zoning laws.

Project Feasibility: Analyzing the impact of FSI on project viability and returns.

Legal Compliance: Ensuring that projects adhere to building codes and approval processes.

Optimization Strategies: Helping developers maximize land utilization while maintaining regulatory compliance.

By consulting with a Real Estate Consulting Company in Bangalore, developers can make informed decisions, ensuring compliance with regulations while maximizing profitability.

Whether you are a builder, investor, or homebuyer, knowledge of FSI helps in making strategic real estate investments. If you are planning a real estate project in Bangalore, partnering with industry experts ensures a smooth and profitable journey.

Conclusion

FSI is a critical aspect of real estate development that impacts project feasibility, valuation, and sustainability. Understanding what is FSI in real estate is essential for developers, investors, and homeowners looking to make informed decisions. Collaborating with a Real Estate Consulting Company in Bangalore ensures that projects comply with FSI regulations while optimizing space and profitability. Whether you are planning a residential or commercial project, professional consultation can help streamline the process, making your real estate venture a success

0 notes

Text

What Is FSI in Real Estate? All You Need to Know

When it comes to real estate development, various factors determine the scope and scale of a construction project. One of the most crucial factors is Floor Space Index (FSI), also known as Floor Area Ratio (FAR). Understanding FSI is essential for developers, investors, and homeowners to ensure compliance with regulations and optimize space utilization. In this blog, we will delve deep into what is FSI in real estate, its significance, calculation, and its impact on property development. We will also explore how a Real Estate Consulting Company in Bangalore can assist in understanding and implementing FSI regulations effectively.

What Is FSI in Real Estate?

FSI, or Floor Space Index, is the ratio of the total built-up area of a building to the total plot area on which it is constructed. It is a regulatory measure used by urban planning authorities to control the density of construction in a given area. The primary objective of FSI is to maintain a balance between infrastructure, open spaces, and population density.

To put it simply, what is FSI in real estate? It is a guideline that dictates how much construction is permissible on a given plot of land. For instance, if a plot has an FSI of 2.0, it means that the total built-up area can be twice the size of the land area.

A Real Estate Consulting Company in Bangalore can provide in-depth insights and guidance regarding FSI norms, ensuring that developers adhere to regulations while maximizing the utility of their land.

How Is FSI Calculated?

The calculation of FSI is straightforward. The formula is:

For example, if a plot has an area of 1,000 square meters and the permissible FSI is 2.0, then the total built-up area allowed would be:

square meters.

Different cities and zones have varying FSI limits depending on factors such as road width, infrastructure, and urban planning norms. Consulting a Real Estate Consulting Company in Bangalore can help developers determine the applicable FSI and plan their projects accordingly.

Types of FSI

1. Basic FSI

This is the standard FSI allowed for a particular zone without any additional premiums or charges.

2. Premium FSI

Developers can avail extra FSI by paying a premium to the governing authorities, subject to specific conditions.

3. TDR-Based FSI

Transfer of Development Rights (TDR) allows developers to obtain additional FSI by acquiring development rights from other landowners or authorities.

4. Special FSI

Some locations, such as transit-oriented developments (TODs), may have special FSI provisions to encourage high-density development near transport hubs.

Importance of FSI in Real Estate

1. Regulates Urban Development

What is FSI in real estate controls the density of construction in a given area, preventing overcrowding and maintaining infrastructural balance.

2. Impacts Property Valuation

Higher FSI can increase property value as it allows more built-up area, making it an attractive investment opportunity.

3. Ensures Sustainable Growth

Urban planning authorities use FSI regulations to ensure balanced growth, optimizing resources and public amenities.

4. Influences Design and Construction

Architects and developers must consider FSI while designing projects to comply with legal norms and maximize space efficiency.

Factors Affecting FSI

1. Location and Zone Regulations

FSI varies depending on whether the property is in a commercial, residential, or industrial zone.

2. Road Width

Wider roads often allow higher FSI as they can accommodate increased population density and infrastructure needs.

3. Type of Construction

High-rise buildings generally require higher FSI, whereas low-density housing developments have lower FSI limits.

4. Government Policies

Local and national policies influence FSI regulations, with periodic revisions based on urban development strategies.

A Real Estate Consulting Company in Bangalore can assist developers in navigating these factors to optimize their projects within the regulatory framework.

How to Optimize FSI for Real Estate Projects?

Maximizing FSI efficiently requires careful planning. Here are some strategies:

Understand Local Zoning Laws: Ensure compliance with municipal regulations.

Utilize TDR: Purchase additional FSI through TDR for larger developments.

Leverage Premium FSI: Consider paying a premium for extra buildable area.

Incorporate Smart Design: Use vertical expansion and space-saving designs.

Work with Experts: A Real Estate Consulting Company in Bangalore can help navigate legal and technical aspects.

Consulting with a Real Estate Consulting Company in Bangalore ensures that real estate projects comply with FSI norms while achieving maximum efficiency.

How a Real Estate Consulting Company in Bangalore Can Help

Understanding what is FSI in real estate and its implications can be complex, especially with varying local regulations. A Real Estate Consulting Company in Bangalore provides expert guidance on:

FSI Regulations: Advising on permissible FSI based on location and zoning laws.

Project Feasibility: Analyzing the impact of FSI on project viability and returns.

Legal Compliance: Ensuring that projects adhere to building codes and approval processes.

Optimization Strategies: Helping developers maximize land utilization while maintaining regulatory compliance.

By consulting with a Real Estate Consulting Company in Bangalore, developers can make informed decisions, ensuring compliance with regulations while maximizing profitability.

Whether you are a builder, investor, or homebuyer, knowledge of FSI helps in making strategic real estate investments. If you are planning a real estate project in Bangalore, partnering with industry experts ensures a smooth and profitable journey.

Conclusion

FSI is a critical aspect of real estate development that impacts project feasibility, valuation, and sustainability. Understanding what is FSI in real estate is essential for developers, investors, and homeowners looking to make informed decisions. Collaborating with a Real Estate Consulting Company in Bangalore ensures that projects comply with FSI regulations while optimizing space and profitability. Whether you are planning a residential or commercial project, professional consultation can help streamline the process, making your real estate venture a success

0 notes

Text

Floor Area Ratio (FAR) in Gurugram: An Overview

Floor Area Ratio (FAR), also known as Floor Space Index (FSI), is a critical parameter in urban planning and real estate development. It defines the maximum allowable floor area that a developer can build on a given plot of land. In Gurugram, a rapidly developing urban hub in India, understanding FAR regulations is essential for real estate developers, investors, and urban planners. i got the writing source from this article

https://manage.wix.com/dashboard/00731eed-d4e6-4943-a812-fb39f414e27c/blog/posts?tab=published&lang

What is FAR?

FAR is calculated by dividing the total floor area of a building by the area of the plot on which it is constructed. For example, if the FAR is 1.5 and the plot area is 1000 square meters, the maximum permissible floor area for the building would be 1500 square meters.

FAR Regulations in Gurugram

In Gurugram, FAR regulations are governed by the Haryana Urban Development Authority (HUDA) and the Department of Town and Country Planning (DTCP). These regulations vary based on several factors, including the type of building (residential, commercial, industrial), the location within the city, and the size of the plot.

Residential Areas

Plotted Developments: For plotted residential developments, the FAR ranges from 1.0 to 2.0 depending on the size of the plot and its location within the city. Larger plots in prime locations typically have a higher FAR.

Group Housing: For group housing projects, which include apartment complexes and multi-family residences, the FAR can go up to 1.75 to 2.5. This higher FAR is intended to encourage vertical growth and efficient land use.

Commercial Areas

Retail and Office Spaces: Commercial properties such as retail outlets, office buildings, and shopping malls are usually granted a higher FAR, ranging from 2.0 to 3.5, reflecting the need for higher density in business districts.

Mixed-Use Developments: Mixed-use developments, which combine residential, commercial, and recreational spaces, are allowed an FAR of up to 4.0 in some parts of Gurugram, promoting integrated urban environments.

Industrial Areas

Industrial Estates: Industrial areas typically have a lower FAR, around 1.0 to 1.5, to account for the larger spaces needed for manufacturing and warehousing.

Factors Influencing FAR in Gurugram

Several factors influence the FAR regulations in Gurugram:

Infrastructure Capacity: Areas with better infrastructure support higher FAR due to the ability to handle increased population density.

Public Transport Accessibility: Proximity to metro stations, bus stops, and other public transport hubs can lead to higher FAR allowances.

Urban Planning Goals: The city's master plan, aiming for sustainable and balanced growth, dictates FAR adjustments to manage congestion and ensure green spaces.

Environmental Considerations: FAR may be restricted in areas requiring conservation of green spaces, water bodies, or heritage sites.

Recent Trends and Developments

The government of Haryana has been actively revising FAR norms to encourage investment and accommodate the city's rapid growth. Recent amendments include increased FAR for commercial buildings and high-density residential projects, reflecting the demand for more living and working spaces.

Implications for Stakeholders

Developers: Higher FAR can lead to greater profitability through increased floor space, but it also demands compliance with stricter building codes and environmental regulations.

Investors: Understanding FAR is crucial for evaluating the potential return on investment in real estate projects.

Residents: Higher FAR can lead to better amenities and more housing options, but it may also result in increased congestion if not managed properly.

Conclusion

FAR regulations in Gurugram are pivotal in shaping the city's landscape. With the continuous evolution of these norms, stakeholders must stay informed and adapt to ensure sustainable development that meets the needs of the growing population while preserving the city's livability and environmental health. for more information visit https://gouriekmeetdesigns.com/

0 notes

Text

"Navigating the Maze: A Comprehensive Guide to Modern Mumbai Residential Property Purchase Regulations"

Mumbai's alluring streets, soaring skyscrapers, and dynamic culture have lured many visitors from all over the world. The "City of Dreams," as it is sometimes called, calls to both aspirants and doers. Understanding the current rules governing the purchase of residential property is essential for individuals looking to settle in Mumbai. To assist you negotiate the complexity and realize your dream of owning a piece of this great city, we shall delve deeply into Mumbai's property market in this blog.

Recognising RERA

One of the largest developments in recent years is the implementation of the Real Estate (Regulation and Development) Act, or RERA. This law was passed to protect homeowner interests and promote transparency in the real estate sector. Developers must register their projects, provide all project-related information, and follow stringent deadlines under RERA. You now have access to important project information as a potential buyer, ensuring that you can make an educated choice.

Registrar of Properties Godrej Khalapur

Although it can be a little stressful, registering your home in Mumbai is an essential part of becoming a property owner. Verifying property titles, confirming there are no legal problems, and paying the necessary stamp duty are all required steps in the registration procedure. To avoid any unpleasant surprises, familiarize yourself with the precise stamp duty rates and registration fees that apply to your home.

FSI Game Navigation

Understanding the idea of Floor Space Index (FSI) is essential in a city where space is at a premium. The amount of construction that is allowed on a specific piece of land is decided by FSI. To make the most of your property while remaining within the law, you must be aware of the various FSI restrictions that apply to different parts of Mumbai.

Clearances in the environment

Environmental concerns have been sparked by Mumbai's growing urbanization, which has resulted in strict requirements for development projects. Make sure a property has the required environmental clearances before investing in it. This safeguards the project's environmental friendliness and safeguards your investment from potential legal issues.

Understand Your Neighbour

Your quality of life may be considerably impacted by the neighbourhood you choose. Consider considerations like closeness to schools, hospitals, public transportation, and safety while conducting a comprehensive investigation of the area. Take your time touring Mumbai's many different neighbourhood, each of which has its own distinct appeal, before making a choice.

Loans and Financial Planning

Mumbai real estate ownership frequently necessitates a substantial financial commitment. To reduce financial burden, factor in the down payment, stamp duty, and registration fees when calculating your budget. Explore the house loan choices provided by banks and other financial organizations as well to ensure you get the finest deal with competitive interest rates.

Legal assistance

It might be difficult to navigate Mumbai's property restrictions, so it's wise to get legal counsel to protect your interests. A skilled real estate lawyer can examine paperwork, guarantee that legal standards are being followed, and help you through the full purchasing process.

Making Your Investment Future-Proof

Mumbai's real estate market is constantly changing. Keep abreast on impending construction projects, metro expansions, and other changes that may have an impact on housing costs and accessibility. A forward-thinking attitude can assist you in making a wise purchase that will endure.

A magnificent residential development called Godrej Khalapur redefines opulent life close to Mumbai. It offers an unmatched lifestyle while being tucked away in beautiful scenery and lush foliage. It's a tranquil haven away from the bustle of the city with beautifully planned apartments, contemporary conveniences, and a peaceful setting. Its advantageous location, which allows for quick access to Mumbai and Pune, makes it a top choice for both city dwellers and those looking for weekend getaways. Godrej Khalapur is a top pick for individuals looking for a harmonic fusion of nature, convenience, and luxury living because of Godrej Properties' commitment to quality and innovation.

Owning a home in Mumbai is a dream come true for many people in a city where dreams are embedded into the very fabric of its existence. Understanding the current rules governing the purchase of residential property is crucial since great dreams come with great obligations.

The real estate market in Mumbai is a complex mix of opportunity and risk, but with the correct information and direction, you can confidently make your way through the maze. When buying a home in this dynamic metropolis, there are numerous factors to take into account, from RERA compliance to environmental permits, stamp duty to neighbourhood exploration.

Keep in mind that Mumbai is more than just a location. And as you go out on your quest to acquire a piece of this lovely city, let the rules serve as your beacon of guidance. Doing so will ensure a smooth and fruitful voyage to your ideal residence in the City of Dreams.

0 notes

Text

FEA & CFD Based Design and Optimization

Enteknograte use advanced CAE software with special features for mixing the best of both FEA tools and CFD solvers: CFD codes such as Ansys Fluent, StarCCM+ for Combustion and flows simulation and FEA based Codes such as ABAQUS, AVL Excite, LS-Dyna and the industry-leading fatigue Simulation technology such as Simulia FE-SAFE, Ansys Ncode Design Life to calculate fatigue life of Welding, Composite, Vibration, Crack growth, Thermo-mechanical fatigue and MSC Actran and ESI VA One for Acoustics.

Enteknograte is a world leader in engineering services, with teams comprised of top talent in the key engineering disciplines of Mechanical Engineering, Electrical Engineering, Manufacturing Engineering, Power Delivery Engineering and Embedded Systems. With a deep passion for learning, creating and improving how things work, our engineers combine industry-specific expertise, deep experience and unique insights to ensure we provide the right engineering services for your business

Advanced FEA and CFD

Training: FEA & CFD softwares ( Abaqus, Ansys, Nastran, Fluent, Siemens Star-ccm+, Openfoam)

Read More »

Thermal Analysis: CFD and FEA

Thermal Analysis: CFD and FEA Based Simulation Enteknograte’s Engineering team with efficient utilizing real world transient simulation with FEA – CFD coupling if needed, with

Read More »

Multiphase Flows Analysis

Multi-Phase Flows CFD Analysis Multi-Phases flows involve combinations of solids, liquids and gases which interact. Computational Fluid Dynamics (CFD) is used to accurately predict the

Read More »

Multiobjective Optimization

Multiobjective optimization Multiobjective optimization involves minimizing or maximizing multiple objective functions subject to a set of constraints. Example problems include analyzing design tradeoffs, selecting optimal

Read More »

MultiObjective Design and Optimization of TurboMachinery: Coupled CFD and FEA

MultiObjective Design and Optimization of Turbomachinery: Coupled CFD and FEA Optimizing the simulation driven design of turbomachinery such as compressors, turbines, pumps, blowers, turbochargers, turbopumps,

Read More »

MultiBody Dynamics

Coupling of Multibody Dynamics and FEA for Real World Simulation Advanced multibody dynamics analysis enable our engineers to simulate and test virtual prototypes of mechanical

Read More »

Metal Forming Simulation: FEA Design and Optimization

Metal Forming Simulation: FEA Based Design and Optimization FEA (Finite Element Analysis) in Metal Forming Using advanced Metal Forming Simulation methodology and FEA tools such

Read More »

Medical Device

FEA and CFD based Simulation and Design for Medical and Biomedical Applications FEA and CFD based Simulation design and analysis is playing an increasingly significant

Read More »

Mathematical Simulation and Development

Mathematical Simulation and Development: CFD and FEA based Fortran, C++, Matlab and Python Programming Calling upon our wide base of in-house capabilities covering strategic and

Read More »

Materials & Chemical Processing

Materials & Chemical Processing Simulation and Design: Coupled CFD, FEA and 1D-System Modeling Enteknograte’s engineering team CFD and FEA solutions for the Materials & Chemical

Read More »

Marine and Shipbuilding Industry: FEA and CFD based Design

FEA and CFD based Design and Optimization for Marine and Shipbuilding Industry From the design and manufacture of small recreational crafts and Yachts to the

Read More »

Industrial Equipment and Rotating Machinery

Industrial Equipment and Rotating Machinery FEA and CFD based Design and Optimization Enteknograte’s FEA and CFD based Simulation Design for manufacturing solution helps our customers

Read More »

Hydrodynamics CFD simulation, Coupled with FEA for FSI Analysis of Marine and offshore structures

Hydrodynamics CFD simulation, Coupled with FEA for FSI Analysis of Marine and offshore structures Hydrodynamics is a common application of CFD and a main core

Read More »

Fracture and Damage Mechanics: Advanced FEA for Special Material

Fracture and Damage Simulation: Advanced constitutive Equation for Materials behavior in special loading condition In materials science, fracture toughness refers to the ability of a

Read More »

Fluid-Strucure Interaction (FSI)

Fluid Structure Interaction (FSI) Fluid Structure Interaction (FSI) calculations allow the mutual interaction between a flowing fluid and adjacent bodies to be calculated. This is necessary since

Read More »

Finite Element Simulation of Crash Test

Finite Element Simulation of Crash Test and Crashworthiness with LS-Dyna, Abaqus and PAM-CRASH Many real-world engineering situations involve severe loads applied over very brief time

Read More »

FEA Welding Simulation: Thermal-Stress Multiphysics

Finite Element Welding Simulation: RSW, FSW, Arc, Electron and Laser Beam Welding Enteknograte engineers simulate the Welding with innovative CAE and virtual prototyping available in

Read More »

FEA Based Composite Material Simulation and Design

FEA Based Composite Material Design and Optimization: Abaqus, Ansys, Matlab and LS-DYNA Finite Element Method and in general view, Simulation Driven Design is an efficient

Read More »

FEA and CFD Based Simulation and Design of Casting

Finite Element and CFD Based Simulation of Casting Using Sophisticated FEA and CFD technologies, Enteknograte Engineers can predict deformations and residual stresses and can also

Read More »

FEA / CFD for Aerospace: Combustion, Acoustics and Vibration

FEA and CFD Simulation for Aerospace Structures: Combustion, Acoustics, Fatigue and Vibration The Aerospace industry has increasingly become a more competitive market. Suppliers require integrated

Read More »

Fatigue Simulation

Finite Element Analysis of Durability and Fatigue Life: Ansys Ncode, Simulia FE-Safe The demand for simulation of fatigue and durability is especially strong. Durability often

Read More »

Energy and Power

FEA and CFD based Simulation Design to Improve Productivity and Enhance Safety in Energy and Power Industry: Energy industry faces a number of stringent challenges

Read More »

Combustion Simulation

CFD Simulation of Reacting Flows and Combustion: Engine and Gas Turbine Knowledge of the underlying combustion chemistry and physics enables designers of gas turbines, boilers

Read More »

Civil Engineering

CFD and FEA in Civil Engineering: Earthquake, Tunnel, Dam and Geotechnical Multiphysics Simulation Enteknograte, offer a wide range of consulting services based on many years

Read More »

CFD Thermal Analysis

CFD Heat Transfer Analysis: CHT, one-way FSI and two way thermo-mechanical FSI The management of thermal loads and heat transfer is a critical factor in

Read More »

CFD and FEA Multiphysics Simulation

Understand all the thermal and fluid elements at work in your next project. Allow our experienced group of engineers to couple TAITherm’s transient thermal analysis

Read More »

Automotive Engineering

Automotive Engineering: Powertrain Component Development, NVH, Combustion and Thermal simulation Simulation and analysis of complex systems is at the heart of the design process and

Read More »

Aerodynamics Simulation: Coupling CFD with MBD and FEA

Aerodynamics Simulation: Coupling CFD with MBD, FEA and 1D-System Simulation Aerodynamics is a common application of CFD and one of the Enteknograte team core areas

Read More »

Additive Manufacturing process FEA simulation

Additive Manufacturing: FEA Based Design and Optimization with Abaqus, ANSYS and MSC Nastran Additive manufacturing, also known as 3D printing, is a method of manufacturing

Read More »

Acoustics and Vibration: FEA/CFD for VibroAcoustics Analysis

Acoustics and Vibration: FEA and CFD for VibroAcoustics and NVH Analysis Noise and vibration analysis is becoming increasingly important in virtually every industry. The need

Read More »

About Enteknograte

Advanced FEA & CFD Enteknograte Where Scientific computing meets, Complicated Industrial needs. About us. Enteknograte Enteknograte is a virtual laboratory supporting Simulation-Based Design and Engineering

Read More »

1 note

·

View note

Text

What is Sellable Areas in Real Estate and Government Guidelines for it

Buying a house in recent times is one of the daunting tasks for a home buyer. Families always look for the best location with the house with the best amenities and ambiance. Inspecting the whole house and knowing about the parties involved are the buyer’s rights. In this manner, one can save money and time by spending much money on the house’s defects shortly.

What is a sellable area?

According to the RERA (Real Estate Regulatory Authority) rules, the saleable area includes the carpet area and the balcony/veranda /terrace according the RERA (Real Estate Regulatory Authority) rules which is only meant for the Allottee. Based on the saleable area, the price is allocated to the flat. In India, while buying a house, home buyers come across the terms such as carpet area, built-up area, super built-up area, and other terms. So, in this article, the reader can come across these three terms and get an overall idea before buying any property.

Some important terms related to the saleable area

Carpet Area — As the name suggests, it is an area on which the carpet can be laid. It is the floor area, including the area covered by the internal partition walls and excluding the area covered by external walls, balconies, open terraces, play areas, etc. It is also known as the net usable area or space in your home. Below is the formula for calculating carpet area:

Carpet area = (area of bedroom + living room +balconies + toilets)

Built-up area — The area of the housing unit includes the carpet area, the thickness of inner walls, outer walls, and the area of the balcony. It also includes unusable areas like balconies, terraces, flower beds, etc. Hence this part of the house seems to be larger than the carpet area. The formula for arriving at the built-up area is as follows:

Built-up area = Carpet area + area of walls + area of the balcony

Super built-up area — It is also known as the saleable area. It includes the carpet area of the housing unit, external walls, balconies, and terraces and also includes a lift, play areas, gardens, gymnasium, and other areas. Nowadays, the builders sell flats based on carpet area, but before it, a super built-up area was used as the space measuring unit. The cost of the property was lowered using the super-built-up area. The formula for calculating the super built-up area is the following:

Super built-up area = Built up area + proportionate common area

The loading factor- It is the sum of the carpet area and the common areas, including the staircase, lifts, service rooms, common corridors, drivers, and other common facilities. It is the difference between the super-built-up area and the flat’s carpet area. The loading factor is less when the residential project does not have any amenities. A loading factor of 1.30 is considered to be sufficient.

Per square foot rate — Builder quotes its rate to determine the flat price. It is based on the saleable area according to the RERA act. It includes the carpet area, additional areas of the apartment, and the building complex such as lobbies, passages, etc.

Floor Area Ratio — It is also known as the Floor Space Index (FSI), which is the proportion of the built-up area allowed on the given plot on the overall area of the plot. This ratio depends on the area, plot size, and the road’s width.

Occupancy Certificate — It is also called the Completion Certificate, which certifies that the construction of the project abides by the local rules, regulations, and laws. The Municipal Corporation generally issues this certificate to the owner of the project.

Open Space Ratio — It is a certain percentage of the space which is issued by the local authorities for the construction of the park. It constitutes about 10% of the total land available for the development, which excludes the footprint of the building.

RERA Policy

Real Estate Regulatory authority (RERA) policy has the provisions for punishing the people who do not follow any rules and regulations while selling a property and thereby helping the buyers to seek legal help. RERA act is the recent court verdict that was implemented on 10th March 2016 by Rajya Sabha. It aims to protect house buyers and boosts real estate investments.

Guidelines under the RERA policy:

Under the RERA act, 70% of the money from buyer and investor will be kept in a separate account, and this can be allotted to the builders only for construction purposes.

The builders have to submit the original documents of the property to the legal office authority.

Previously, the developers sell properties based on the super built-up area. But according to this Act, the developers are now instructed to sell the property based on the carpet area.

Within the 5 years of purchase, the builder must rectify any issues faced by the buyer or may face a penalty. The regulator cannot advertise, sell, build, invest or book a plot without registering with the regulator.

The authority will have jurisdiction over the land project when the real estate is registered with RERA Act.

Benefits of RERA:

It standardizes the carpet area.

It reduces the risk of the builders handling multiple projects simultaneously.

It gives the buyer the right to information about the project.

Apart from this, there are other benefits of the RERA Act that include buyers’ rights in case of false promises.

Conclusion

The price of a property recently is based on the saleable area or carpet area according to the guidelines of the RERA Act. In this article, the reader gets an overall idea about the related terms while buying a property from the builders and evades the problems on the way while purchasing the property with the help of legal laws and authorities. The reader can also have a brief idea about the RERA act guidelines and their associated benefits.

#carpetArea#saleableareas#SuperbuiltupArea#RecentCourtVerdict#Panelty#Buyerrights#HonestBroker#realestate#RERA#branding#business#advertising#marketing#india#propertiesinindia#zerobrokerage

0 notes

Text

GST on Real Estate Transactions involving Joint Development Agreements / Transfer of Development Rights wef 1st April 2019 (JDA/TDR)

Construction and Real Estate is a complex business with multiple stakeholders involved in it. It has been a growing sector in India, but ironically has been riddled with litigation owing to multiplicity of taxes and dual administration mechanism; thereby exposing it to the conundrums of both Central and State level complex indirect taxation levy prior to GST regime.

However, with the series of changes that have been made effective from 1st April, 2019 it can be seen as a step in the right direction, although it may not be in line with the GST principles. These changes are enumerated in GST Notification No. 03/2019 – Central Tax (Rate) dt. 29.03.2019 and Notification No. 08/2019-CTR dt. 29.03.2019.

This article is an attempt to summarize the changes made in GST Law effective from 1st April 2019, with respect to its impact on Real Estate Business, involing Joint Development Agreement/Transfer of Development Rights (JDA/TDR) where consideration is in the form of Area Sharing and / or Revenue Sharing. This article does not cover any of the provisions of GST on Real Estate applicable on or before 31st March 2019, nor any transitional provisions for Ongoing Projects as on 31st March 2019.

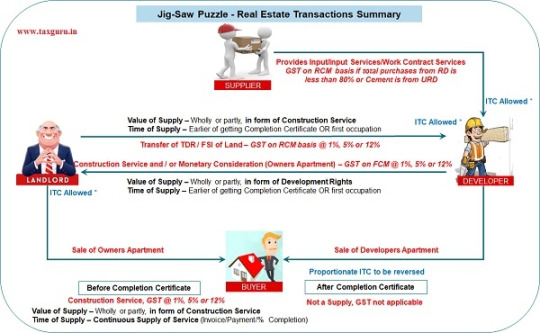

Let us now understand the various parties that could possibly be involved in a typical real estate business end-to-end and the implications of GST on transactions between them.

Typically, any real estate transaction starts with Developer acquiring land for constructing a building (Residential/Commercial) upon it. Land is either purchased outright from the Landowner, or the Developer enters in to “Joint Development Agreement” (JDA) with the Landowner, whereby

The Developer Acquires the Development Rights from Landowner with respect to the Land

The Development rights entitles the Developer to obtain various types of licenses and approvals from the Government authorities and construct a complex, building, civil structure on the land, either by himself, by acqiring material and labour from Suppliers or getting work done through Works Contractors

In return for the transfer of development rights by landowner, the Developer gives the Landowner consideration in the form of Cash (Revenue Sharing) or Construction Service for certain agreed number of apartments/offices/shops (Area Sharing) allotted to Landwoer (hereinafter referred to as “Owners Apartment”) or both

The remaining apartments/Offices/Shops (hereinafter referred to as “Developers Apartment”) are retained by Developer and sold to other Buyers

Landowner may also sell Owners Apartment independently to Buyers or decide to retain it for own use

So in a nutshell, there are 5 parties typically involved in a Real Estate transaction, which has an impact of GST – Landowner, Developer, Supplier, Works Contractor and Buyer.

Various Transactions in a JDA type of agreement and its GST Impact: Flowchart 1

For ease of reading, we have divided this article into 2 sections as below:

1. Definitions

2. Type of transactions and its taxability

1. Definitions and Terms used in this article

Supply – As per para 5(b) of Schedule II of CGST Act, the following is ‘supply of service“:

..(b) Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier

As per para 6(a) of Schedule II of CGST Act, the following composite supplies shall be treated as a supply of services, namely:

..(a) works contract as defined in clause (119) of section 2

RREP – Residential Real Estate Project (RREP) means a Real Estate Project in which the carpet area of the commercial apartments is not more than 15 % of the total carpet area of all the apartments in the project.

REP – Real Estate Project (REP) means any project other than RREP.

RCM – Reverse charge (RCM) means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act

FCM – Forward Charge (FCM) means the liability to pay tax by the supplier of such goods or services

ITC – Input Tax Credit (ITC) means credit of Input Tax

2. Type of transactions and its taxability

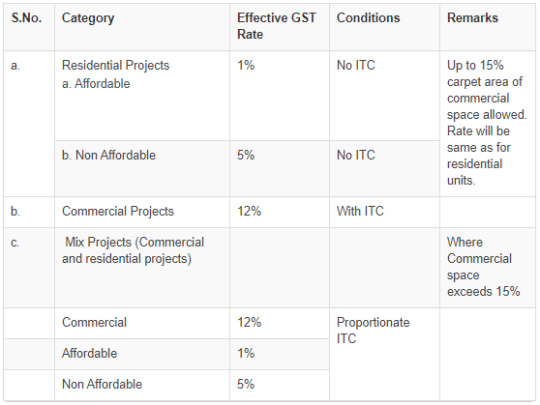

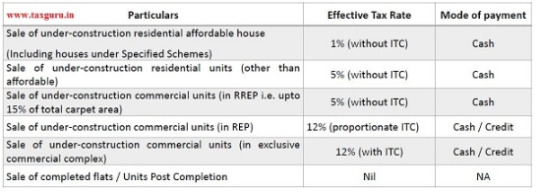

2.1 Sale of units by Developer/Landowner to Buyer – Outward Supply for Ongoing Projects (option not exercised for old rates) and New Projects (01.04.2019 onwards)

In this transaction, either the Developer and/or Landowner sells apartments/shops/offices to the Buyer. This is a simple transaction with the Buyer and GST would be leviable as below, if unit is sold before receipt of Completion Certificate or before its first occupation:

Table 1:

If the entire consideration for the property is received after receipt of Completion Certificate or after its first occupation, whichever is earlier, then it is not considered as a Supply and hence GST is not applicable in such transaction. ITC proportionate to the unsold units as on the date of Completion of the project should be reversed upon completion of the project.

Time of Supply – Continuous supply as per %Completion/Invoicing/Payments received

Input Tax Credit:

Landowner

Entitled to ITC of GST levied by developer on construction of owner’s apartment (refer Flowchart 1) subject to cap of output tax payable on residential apartments sold under construction. For e.g. If the developer charges GST of Rs. 1 lakh to the Landowner, the Landowner should pay at least Rs. 1 lakh as output GST on supply of such apartment to his buyer.

However, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Developer

Not entitled to any ITC in respect of sale of under construction/completed residential units (in any project) and under construction/completed commercial units (in RREP).

ITC can be claimed only on inputs and input services used (see Flowchart 1 above):

for sale of under-construction commercial units (in exclusive commercial complex), or

for sale of under-construction commercial units (in REP), where proportionate ITC can be availed only for the commercial units based on ratio of carpet area of commercial units sold to total carpet area of residential and commercial units

Computation & Reporting of ineligible ITC

ITC not availed should be reported every month by reporting the same as ineligible credit in Form GSTR-3B.

On the final computation done for the financial year, the final adjustment (excess/short) needs to be carried out in Form GSTR-3B or through Form GST DRC-03 in the month not later than the month of September following the end of financial year in which the cut-off date occurs (ie Project is completed), as follows

Excess ITC availed: Such excess need to be reversed along with interest @18% from 1st of April of such financial year till the date of reversal.

Short ITC availed: Same can be claimed as credit in the return filed not later than September following the financial year in which the cut-off date occurs (ie Project is completed).

Mode of Payment of Output Tax:

80% Condition:

The new lower GST rates on construction of residential housing or commercial units in RREP is subject to procurement of 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease premiums)) from registered persons.

However, the value of the following services used in the construction of residential apartments are excluded for this calculation:

Grant of developmental rights

Long term lease of land

Floor space index

Value of electricity

Value of high-speed diesel

Motor spirit and natural gas

Salary to employees (neither a good nor a service as per clause 1 of the Schedule III of CGST Act, 2017)

Land value (as per Schedule III, Entry No 5, of CGST Act, sale of land is not a supply)

On shortfall of purchases from the 80 percent from registered dealers, builder shall be required to pay tax under reverse charge (RCM) at 18 percent, provided that on procurement of cement from unregistered dealers the rate shall be 28 percent rate and procurement of capital goods from unregistered dealers shall be liable to the applicable rate of tax. The tax liability on the shortfall of inward supplies from unregistered person would be added to his output tax liability in the month not later than the month of June following the end of the financial year in which inputs/input services were purchased.

2.2 Transfer of DR/TDR/FSI for Construction of Residential apartments / Residential part of Mixed Project (having both Residential and Commercial Apartments)

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability:

Transfer of DR/ TDR/ FSI used for sale of under construction residential units is exempt

Taxable to the extent of unsold residential apartments on the date of issuance of completion certificate or first occupation, whichever is earlier

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer – ITC not eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Earlier of

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

Lower of

18% on Value of DR/TDR/FSI in proportion to carpet area of such unsold residential apartments & all commercial apartments to total carpet area of residential apartments & commercial apartments; or

1% / 5% of Value of such unsold apartments & all commercial apartments. Value of unsold apartments is deemed to be equal to value of similar apartments charged by the promoter nearest to the date of completion certificate or first occupation, whichever is earlier

2.3 Transfer of DR/TDR/FSI for Construction of Commercial apartments

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer:

For RREP (with Commercial portion less than 15%) – ITC not eligible For REP – ITC attributable to Commercial portion can be claimed For Commercial projects – ITC is eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Area Sharing:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Revenue Sharing:

SRA Projects (continuous supply of service) – Periodical release of FSI;

JDA projects – Date of transfer of DR/FSI irrevocably

Outright purchase – Date of transfer of DR/TDR/FSISRA Projects (continuous supply of service) – Periodical release of FSI;JDA projects – Date of transfer of DR/FSI irrevocably

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

18% on Value of DR/TDR/FSI

2.4 Construction Service for Owner’s Apartment (aplicable only in case of Area Sharing agreement)

Developer provides Construction service to Landowner over a period. The Developer hands over the ownership rights of certain percentage of the developed area ie. Super Structures like complex, building or civil structure or apartments to the landowner (in Area Sharing JDA), referred to as Owner’s Apartment in Flowchart 1 above.

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under FCM)

Input Tax Credit to Landowner (for tax paid under FCM by Developer):

Landowner would be eligible to take credit of taxes paid by him to the developer and can be availed for paying the taxes on sale of the owners apartment to his buyers before issuance of completion certificate or first occupation, whichever is earlier, sold by the Landowner independently.

However, as discussed before, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Time of Supply / Payment of Tax:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of Construction service for Owners Apartments):

Value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

GST Tax to be Paid:

Developer shall pay tax on owner’s area at the time of completion certificate or first occupation, whichever is earlier. Rate of tax will be either 1%, 5% or 12% depending on whether the owners apartment is affordable Residential, Residential or Commercial unit (see Table 1 above)

Conclusion

Time will tell whether the reduced GST rates for under-construction properties will give the necessary fillip to the real estate sector which is currently witnessing adversities. The concern regarding the reduced rate of 5% and 1% is that it is offered without the ability for developers to take input tax credit, which could actually lead to an escalation of costs.

In addition, more clarity from CBIC needs to be provided on how the Landowner can avail input tax credit in respect of the GST on construction service for Owners apartment charged by the Developer, as discussed in earlier sections, as this could also have a significant impact on price point of the apartment sold to ultimate buyers.

Disclaimer: The views, opinions and arguments presented in this article are those of the author and may not necessarily reflect legal standing. While every effort has been taken to provide correct information, the author will not be liable for any loss, expense, liability, detriment or deprivation suffered arising out of any action based on the information provided above. The readers are expected to cross-check the facts and information with government circulars and notification.

Author: CA Rahul Jain can be reached at [email protected]. More details on http://rahuljainassociates.in

0 notes

Text

TIPS TO MAKE GOOD HOUSE/ HOME

Execution of a project and its design is a very crucial stage in any project. It involves not only architects but also builders, contractors, consultants, project manager, site supervisors and labours. As the work progresses step by step, complexity of the project also increases.

So, here are some steps that will help you to understand how to build a project and its design from its very initial stage.

1.APPOINT AN ARCHITECT

Architects form base of any project. They are the one who create a simulation of a building that is going to stand on a site in practicality. Appointing a good architect with innovative skills and a decent experience will help to achieve the goals.

While appointing an architect, an appointment letter should be signed duly as an agreement between both the parties and to understand professional fees of the project initially.

2.REQUIREMENTS

To start design of any building, requirements are the foremost part of the process. Requirement list involves two types of requirement i.e., user requirement in which the owner forms a brief about how he wants to build the project and other one is site requirement which is understood and studied by the architects to meet the needs of the client with respect to existing site conditions.

Document requirements and other project requirements are also the part of this process.

3.PROPERTY LEASE/ OWNERSHIP DOCUMENTS

Property lease or ownership documents are must to initiate a process of building a project. A land owner should have all the documents of sale deed/ ownership etc. approved from legal authorities or municipal corporations to start a project.

4.SITE SURVEY

A proper site survey which includes survey of existing physical features such as roads, services, surrounding buildings or structures etc. and contour information is necessary to understand the context of a site. It becomes easier to design a project after understanding the existing site conditions as mentioned above.

5.SKTECH DESIGN AND ROUGH ESTIMATE

Initial design agreement is done with the client by a sketch proposal to check if all the needs are satisfied or not. If the initial design is finalized by the client then the rough estimate of the project is prepared; which includes and specifies the essential things required and its implementation on site.

An estimate is a fee structure which includes rough costing of all the works that will be executed during the construction of a project. It reflects overall rough cost of the project that is going to be executed on site.

6.MUNICIPAL DRAWINGS

Municipal drawings are prepared with all the technical details such as FSI calculations and area calculations with all the rules and regulations that are described in the Development Control and Regulations (DCR) prepared by the authority. Then the drawings are submitted for approval. After approval, further process of the project is continued as per the requirements.

7.WORKING DRAWINGS, SPECIFICATIONS AND TENDER DOCUMENTS

After preparation and approval of municipal drawings, working drawings are prepared which includes all the detailed drawings starting from centre line plans, plinth level plan, beam and slab layout, electrical plans, plumbing layout, etc. All the details and specifications are mentioned in each drawing as per the requirement for the better understanding of the work on site.

Specification list is also separately prepared to mention all the specified materials that will be used in construction as well as its dimensions and physical attributes.

After the preparation of these drawings, tender documents are released by the tenderer which is an offer to carry work as specified in the specifications list. A tender can be different type depending upon the type of the project. It could be for a construction work, demolition work, material supply, cleaning work or painting work, etc. A tender can be public/ open or invited/ closed tender.

8.CONTRACT

As per the tender documents, one contractor is selected for the construction work process under the contract document following the contract act. Then the work order is released from architect in accordance with the owner.

To carry out good construction work from the contractor; Earnest Money Deposit (EMD) is kept from the contractor’s bill. If the work is not completed within the given amount of time then refund of the EMD is denied as per the terms specified in contract.

9.BILL OF QUANTITIES

A bill of quantities is specification of materials required to carry out the construction works or materials used for construction of window or doors etc. All the materials and its quantities should be properly mentioned in the bill as it cannot be changed once the work is started. To change or add any specifications in the bill of quantities a special document has to be passed and approved by the authority.

10.COMPLETION CERTIFICATE

Once the construction work is completed and all the formalities are done as per the contract, then, the building is inspected for next 6 or 8 months or a year for any defect. This is called as defect liability period. If the building is without any defects then it will be given completion certificate by the respected authorities.

Briefly, we can conclude that, above mentioned factors play a crucial role in the construction process of a building step by step. Some of these factors may vary as per the site location and the rules and regulations followed by that particular area. But overall structure of a construction process of a building which is designed is similar to these factors.

We should understand that every process requires a specified time and a team to be carried out as per the requirements and sometimes it might turn into a failure also. To avoid this factor of risk one should always appoint a good workforce and communicate at every stage of the work to check if the work going on is okay or not.

Respecting and following all of the agreements is also one of the important factors to carry out a successful project. In this way, one can assure a successful building of a project and design as per the needs and requirements.

#Residential house plan in india#Best interior design services#Online front elevation#Online Home Plan Designs

0 notes

Text

Residential Projects On Dwarka Expressway

Residential Projects On Dwarka Expressway / Buy Luxury Homes in Gurgaon

Real Estate Terms to Know While Searching For Residential Projects in Dwarka Expressway

It is a recognized reality that just how intricate is the connection between a builder and also home-buyer. One could always witness a stress between the two during a property transaction as well as of the prime aspects of concern is the 'CARPET AREA'. These terms will aid you to study wisely while you are visiting domestic tasks in New Housing Projects On Dwarka Expressway. Be it old or recently built 2 or 3 BHK Apartments in Dwarka Expressway or other location in Gurgaon ensuring the appropriate info concerning the building is essential. The terms that will certainly help you are:

Rug Location: This consists of the area over which carpeting could be laid and also takes the complete room inside the home right into the calculation. Buy Property on Dwarka Expressway owns exclusive right on this component of the residential property. Often numerous developers exclude spaces like bathroom and also cooking area from this dimension. Nevertheless, customers ought to note that these must be thought about. This does not consist of usual spaces outside the apartment or condo like the stairs; elevator, protection space, etc. are omitted from this computation. This estimation additionally does not consist of any type of area inhabited by the wall surfaces of your home. The carpeting area, symmetrical to the incredibly built-up area or saleable area, is something that has been a reason of dissonance between the builder as well as home-buyer.

Developed location: Carpeting area + location of walls and also air ducts. It includes around 10% - 20% more than the rug area. A terrace is considered as fifty percent of the real space for determining the built-up location. Some tasks bill completely dry balcony same as inner areas.

Super built-up area: This computation includes usual services like the lift shafts, lobby, as well as a hallway, proportionately split amongst all apartments. Typical facilities such as a pool, garden and club might be consisted of in it relying on the designer.

Per square foot price: This term is usually applied as explained by the developer on the extremely built-up location to determine the worth of the level. This is the reason occasionally incredibly built-up space is additionally referred to as the salable location.

Flooring Area Index (FSI): This is the availed ratio enabled by the government for a particular area in between the total built-up area and story room. Normally, the Costs FSI refers to the authorization gotten to build added flooring room by paying an agreed premium.

Typical areas: Nearly all brand-new Residential Projects On Dwarka Expressway focus mostly on providing special common space. These consist of structure, land and also services that are utilized by all of the system owners. The citizens share the common costs of their operation and also upkeep. Commonly the typical areas include pool, tennis courts, children play zones, and various other leisure facilities, as well as the area used for usual passages of the structure as well as parking lots at Affordable Housing Projects Dwarka Expressway.

For more information:- Contact Here: Shalabh Mishra Mobile: +91 9212306116 Gmail: [email protected] Skype: shalabh.mishra Kindly Visit: http://www.dwarkaexpresswaynewproject.in/residential

youtube

0 notes

Text

Real Estate Consulting Company in Bangalore